Fixed errors related to the autogeneration of node captions, the SQL Script and Tree Union components, operating temporary tables, and the MS SQL connection under Linux, as well as some other bugs and...

Implementing a Decision Support System: A Case of One Financial Organization

How to migrate to a modern analytical platform and replace the database without stopping the work of the decision making pipeline. An actual case of a leader of the microfinance market.

The Finance Organization is one of the leaders of the microfinance market that specializes in issuing loans to individuals.

- More than 950,000 loans over 7 years

- An 18% share of the total size of the microloan market

- 430 000 dollars of loans issued in 2021

The situation before the start of the project

- The credit pipeline was built on another soft.

- The pipeline operated as a synchronous web service.

- The pipeline was designed for a maximum of 10,000 applications per day.

- 9 decision-making strategies were implemented on another soft.

Problems

- The pipeline ran fine, but the outdated soft was outdated.

- 12,000 applications were processed per day, exceeding the project capacity.

- Scaling problems due to the 32-bit version of the outdated soft.

- If the credit pipeline stopped, it took too long to find the reason for the failure.

- The average processing speed of the application was 36 seconds, the maximum was 108 seconds. A faster speed wasa required.

- Initially, the pipeline was designed for only one strategy of the decision-making system, but over time that number rose to 9. Consequently, it became more difficult to introduce changes.

- The outdated soft interface was not too user-friendly.

Tasks

- Carry out the transition to Megaladata without stopping the credit pipeline.

- Provide the possibility of both horizontal and vertical scaling.

- Perform script refactoring.

- Switch from Oracle DBMS to PostgreSQL.

Solution

- The Megaladata Decision Maker solution was used.

- The asynchronous call of the decision support system was implemented immediately out of the box.

- The format of input and output data had not changed: only the internal implementation had changed.

Results

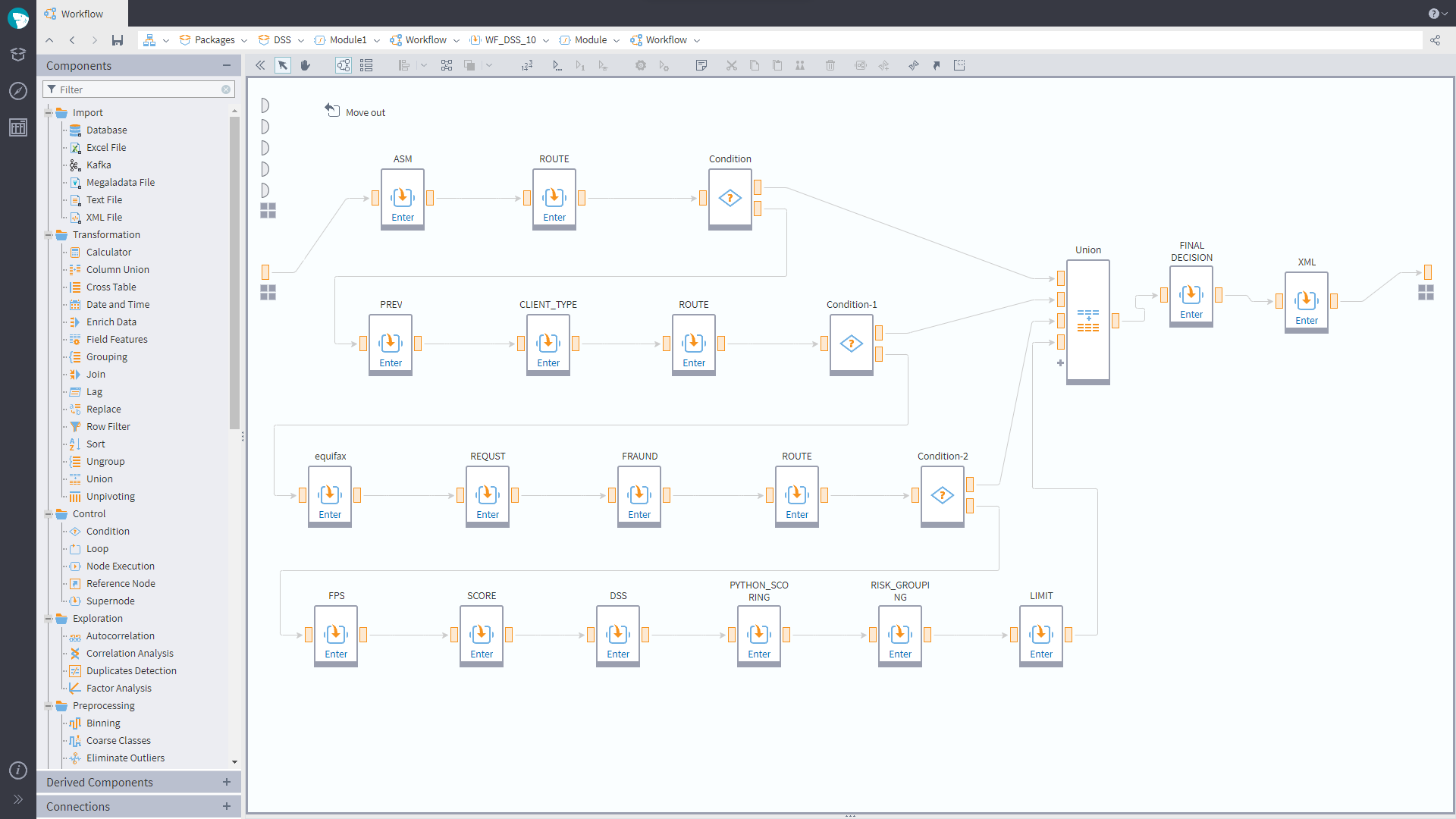

The Credit Pipeline Workflow

- As of September 2023, the first strategy out of 9 has been implemented on Megaladata, which is API-compatible with the solution that was built on the outdated soft. The remaining strategies continue to work on the outdated soft.

- The migration of the first strategy from the outdated soft to Megaladata took 2 months. The remaining strategies will be transferred in 2-4 weeks each.

- The possibility of vertical scaling of capacities has appeared.

- The transition to Megaladata is combined with the change of the Oracle DBMS to PostgreSQL.

- The transition to a modern low code platform enables users to quickly and independently introduce changes into the work of the decision-making system without needing to involve a contractor.

- The Megaladata interface has become more intuitive, so the question of using the platform as a BI tool is being considered.

See also

Process Mining Development Trends

An overview of process mining trends: from retrospective analysis to AI-powered forecasts, from diagnostics to automated recommendations, and from isolated processes to a complete, interconnected view...

Megaladata 7.3—A Major Release

Megaladata 7.3 significantly expands its component library, introducing powerful new tools for working with data trees: converting data trees to JSON and vice versa, joining trees, or combining tree structures....

About Megaladata

Megaladata is a low code platform for advanced analytics

A solution for a wide range of business problems that require processing large volumes of data, implementing complex logic, and applying machine learning methods.

GET STARTED!

It's free